The impact of Coronavirus continues to expose interesting scenarios. One that pops out is the corporate bond market is now frozen.

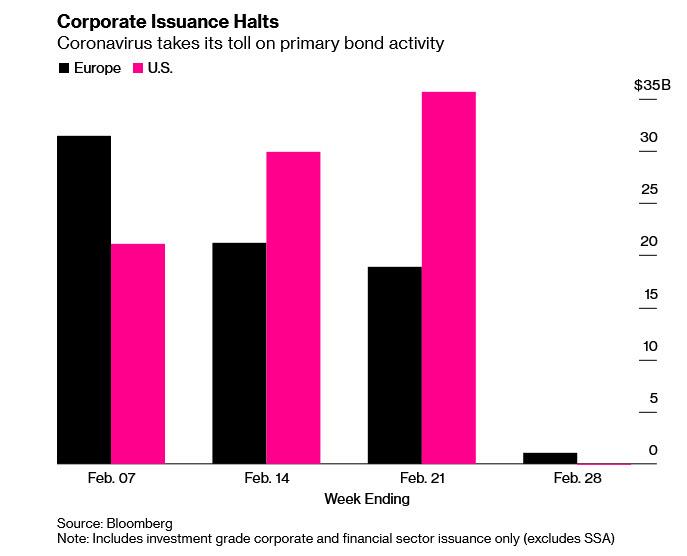

The first 3 weeks of February bonds in the US and Europe combined for $150B+ in new bonds. These bonds fund everything from M&A to factories to paying off other high interest rate debt.

The first 3 weeks of February bonds in the US and Europe combined for $150B+ in new bonds. These bonds fund everything from M&A to factories to paying off other high interest rate debt.

Now 4th week of February, bond issuance is basically zero. Companies like the state of Illinois does not have a rainy day fund. If companies are living off debt issuance and that market is now gone, who has their cash managed well enough to keep things rolling.

Companies that manage their cash well, will dominate their competition. If they don't manage their cash, which for the last 10 years, why, when debt is cheap, but not cut off, they may not have the know-how to manage it.

Look to companies balance sheets for cash on hand and how long they can survive. Maybe all those loans to do stock buybacks will result in companies being forced to dump shares to raise cash if the Frozen continues for an extended period of time.