Wild Rides, Who should be scared?

+/- 1000 point swings. Once day, we are back, next day we are sunk, rinse and repeat. Repo rates are over subscribed. Nearly $300B in the last few days issued. Why the liquidity problem. The Feds not QE4 will have pumped nearly $1T in 6 months. And still not stabilizing. Bonds heading to zero and catching up with friends in Japan & Europe when the US hits negative yields.

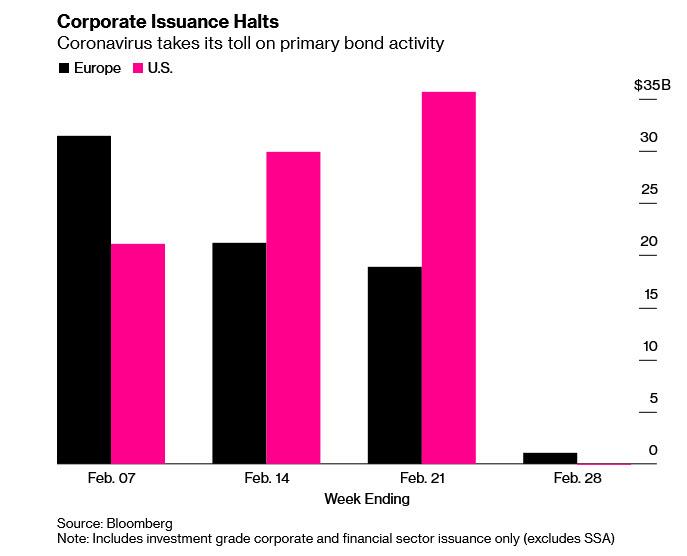

The first 3 weeks of February bonds in the US and Europe combined for $150B+ in new bonds. These bonds fund everything from M&A to factories to paying off other high interest rate debt.

The first 3 weeks of February bonds in the US and Europe combined for $150B+ in new bonds. These bonds fund everything from M&A to factories to paying off other high interest rate debt.