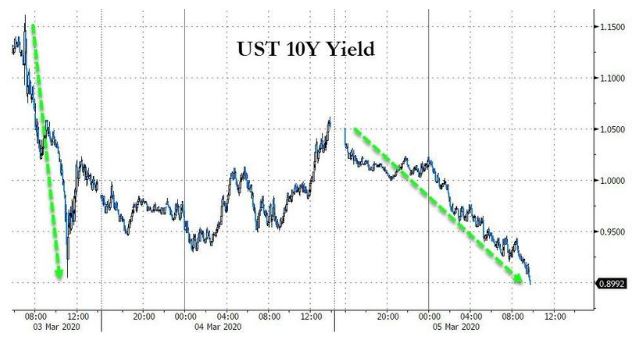

+/- 1000 point swings. Once day, we are back, next day we are sunk, rinse and repeat. Repo rates are over subscribed. Nearly $300B in the last few days issued. Why the liquidity problem. The Feds not QE4 will have pumped nearly $1T in 6 months. And still not stabilizing. Bonds heading to zero and catching up with friends in Japan & Europe when the US hits negative yields.

The Fed is in an interesting situation. Admit their not QE4 is QE4 or have to cut off the money. The banks are riding  the coaster because they will have access to the cash no matter what. Maybe that is the power struggle now. The banks may know that the Fed has to pay up to keep the party going. If the Fed stops it all collapses.

the coaster because they will have access to the cash no matter what. Maybe that is the power struggle now. The banks may know that the Fed has to pay up to keep the party going. If the Fed stops it all collapses.

Wonder who will blink. At the end of the day Main Street is going to get hurt. The blame in 2008 were the greedy uneducated masses taking advantage of a housing market......The blame for 2020 a virus? Not the greedy educated elites that has pumped it to a live unimaginable in 2008.